az auto sales tax calculator

Average Local State Sales Tax. The Arizona Vehicle License Tax VLT is a mandatory vehicle registration fee for Arizona drivers.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

The Arizona VLT Vehicle License Tax is the major fee among others that you have to pay every 1 to 2 years when you register your gasolinediesel vehicle at the Arizona Division of Motor.

:max_bytes(150000):strip_icc()/GettyImages-649719504-62b7bc84aa6c47a7ba6c985cd65a8e4e.jpg)

. 42-5061 A 28 a provides an exemption from state TPT and county excise tax for sales of motor vehicles to nonresidents from states that do not provide a credit for taxes paid. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. This Auto Loan Calculator automatically adjusts the method used to.

Using the values from the example above if the. It is assessed in the place of personal property tax that is charged in other. Maximum Local Sales Tax.

Multiply the vehicle price. However the total tax may. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

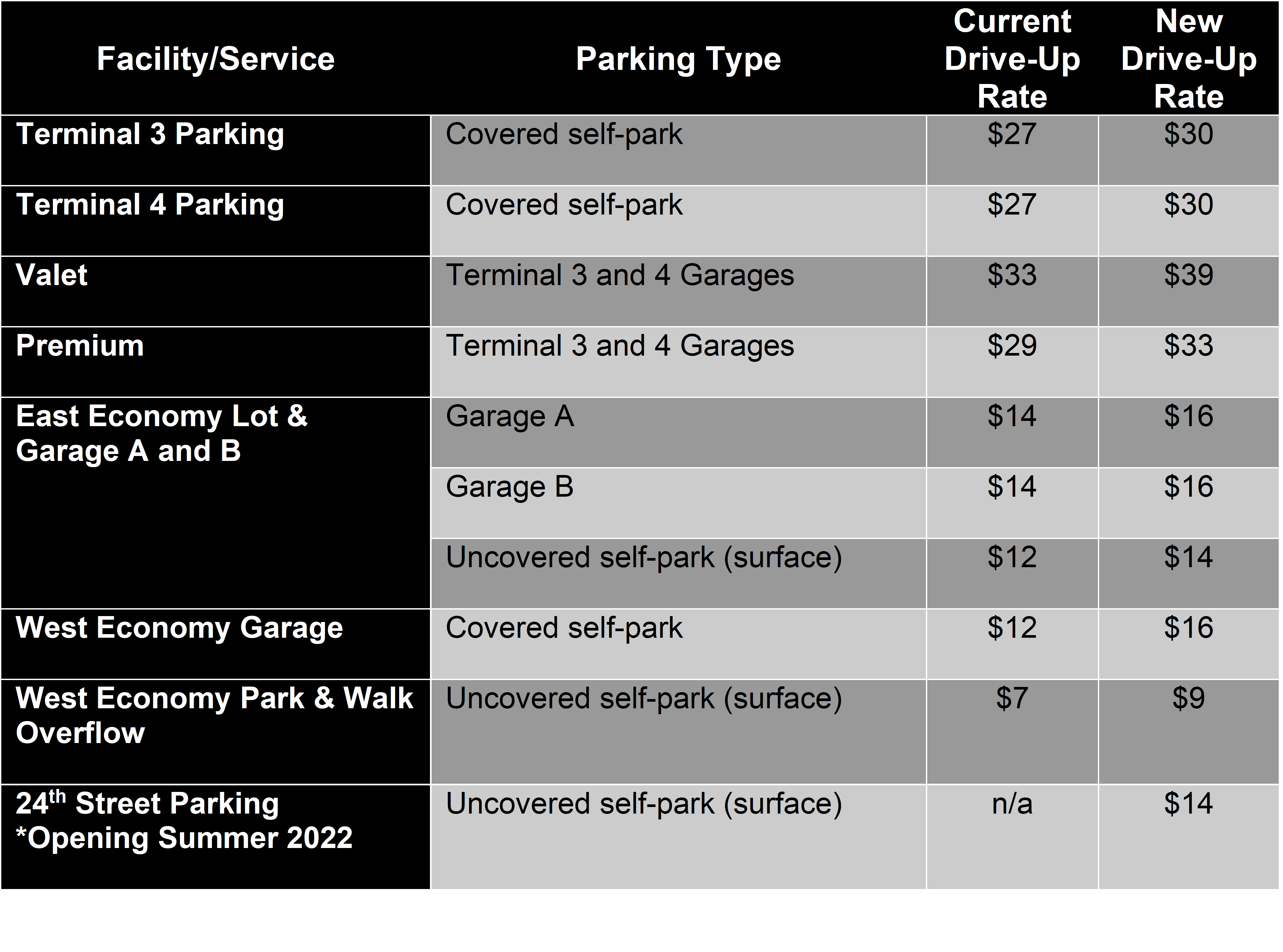

Arizona has a 56 statewide sales tax rate but also. For vehicles that are being rented or leased see see taxation of leases and rentals. See what monthly car loan payments in Mesa AZ would be on a new car truck van or SUV from Arizona Car Sales.

Sales tax is calculated by multiplying the. 1648 E Main St Mesa AZ 85203. Price of Accessories Additions Trade-In Value.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. The minimum is 56. Some states provide official vehicle registration fee calculators while others.

How to Calculate Arizona Sales Tax on a Car. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Unfortunately the price isnt.

Arizona collects a 66 state sales tax rate on the purchase of all vehicles. Sales Tax Calculator. Real property tax on median home.

How much is the car sales tax rate in Arizona. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. All used and new car purchases in Arizona have the statewide sales tax of 56 applied to them.

This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. Tax Paid Out of State. 54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price.

Arizona State Sales Tax. Sales Tax State Local Sales Tax on Food. The Pima County Arizona sales tax is 610 consisting of 560 Arizona state sales tax and 050 Pima County local sales taxesThe local sales tax consists of a 050 county sales tax.

Maximum Possible Sales Tax.

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

States With No Sales Tax On Cars

A Complete Guide On Car Sales Tax By State Shift

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

How To Calculate Auto Sales Tax For A Resident Of Arizona

Arizona Sales Tax Guide And Calculator 2022 Taxjar

New 2021 Hisun Strike 250 Utility Vehicles In Ontario Ca Hi21164 Voodoo Blue

States With The Highest And Lowest Sales Taxes

What S The Car Sales Tax In Each State Find The Best Car Price

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Vehicle Title Tax Insurance Registration Costs By State For 2021

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax On Cars And Vehicles In New Mexico

City Of Phoenix Public Notice Tax And Fee Changes

Sales Tax Calculator Check Your State Sales Tax Rate

Car Tax By State Usa Manual Car Sales Tax Calculator

What New Car Fees Should You Pay Edmunds

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation